*This is not a sponsored post, neither an advertorial.*

But since I received quite a number of queries regarding this, hence I decided to blog and share based on my own experience.

I've been traveling for more than 10 years and throughout my travel record, the number of times using credit or debit card when travel abroad can be calculated using all my 10 fingers, or even lesser. Except for the part where I need to do all the bookings like hotel/hostels, transportation and even entrance tickets prior to my trip, I would try my best not to use both credit and debit cards due to its unflavourable exchange rates. Not until I was introduced with BigPay card.

What Is BigPay Card?

BigPay is a prepaid Mastercard with a mobile app that will not only save your time but as well as your money in anywhere around the world. It works as an e-wallet but with the accompany of physical card. Let's say if the shop or restaurant you visit doesn't accept e-wallet payments, you'll still be able to pay your transaction by using your BigPay card.

Why You Should Apply BigPay Card?

1) Best and Favourable Exchange Rate

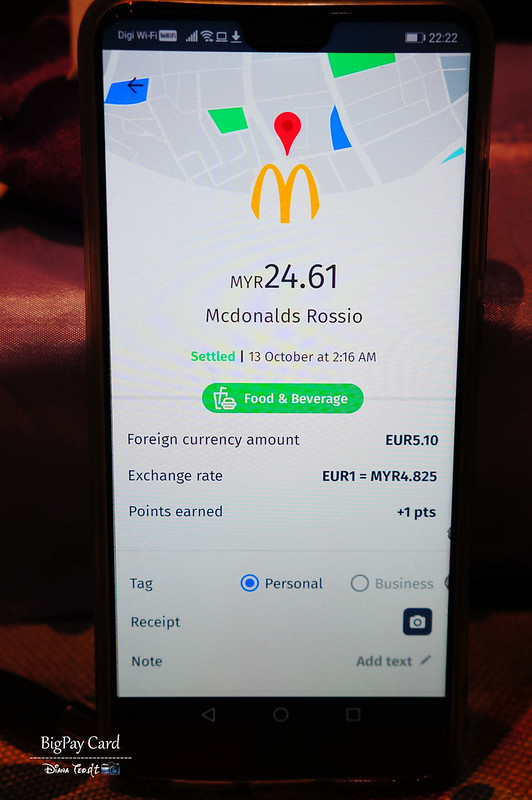

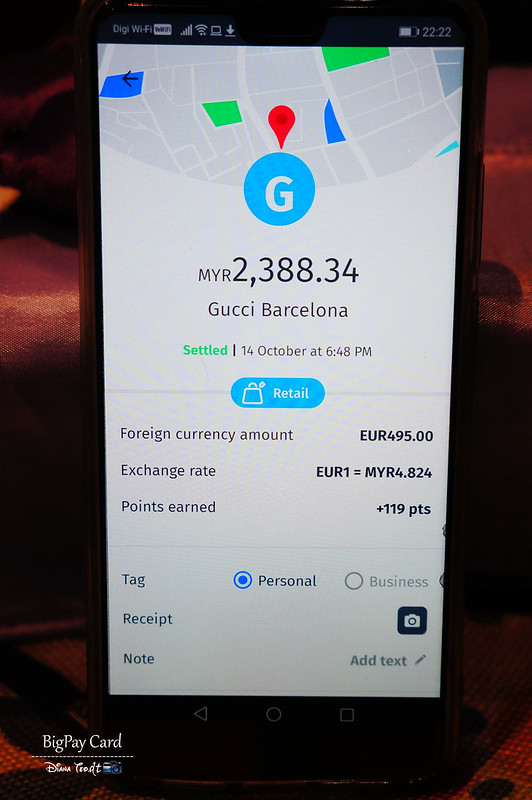

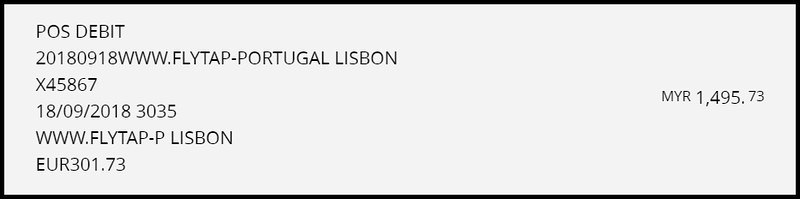

This is the ultimate reason why I apply for a BigPay card. I heard a lot and saw many comments on social media network saying that BigPay card offers the best and favourable exchange rate when spending abroad and it's really true. Let's take a very good example of my recent trip to Europe last October. Before leaving for my trip, I went and exchanged in the money changer for €1.00 = RM4.88. But when I used my BigPay card to pay for McD's meal in Portugal, the rate was €1.00 = RM4.82. Probably you can't see the differences when spending in small amount of money but in the case you can't help yourself from buying luxury handbags (like my cousin did), then you will see the significant difference. Even my own CIMB debit card charged me at the rate of €1.00 = RM4.96 (refer the third photo). So heartpain!

The transaction of using CIMB Debit card. You do the maths of the exchange rate.

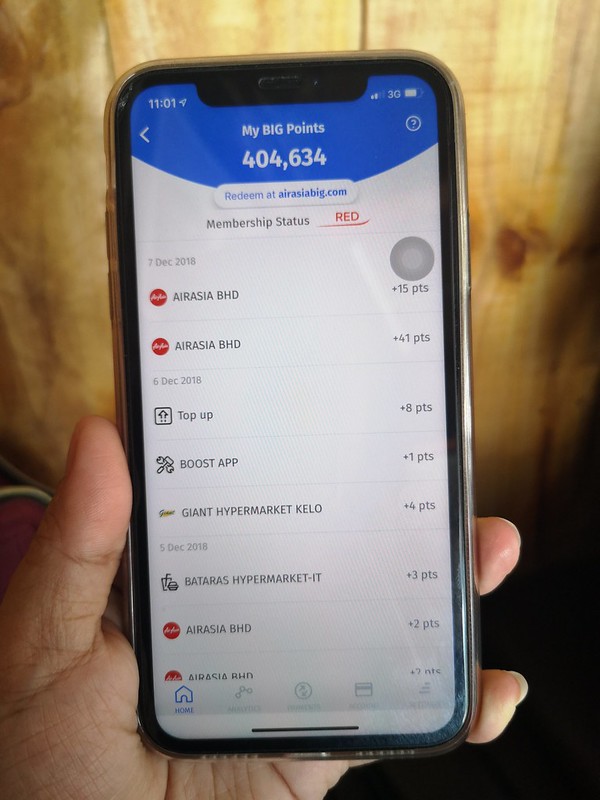

2) Earning and Collecting AirAsia Big Points

As per other e-wallet players here, BigPay also have its own rewards system through AirAsia Big Points. You can link your AirAsia BIG member ID to your BigPay account by using your email. Many of my friends keep asking me how I managed to earn and collect points like up to more than 75,000, oh well I should say thanks to BigPay card to be exact. Most of them thought I get all this points by flying with AirAsia frequently but the truth is through top-up or make any purchases on my daily spend by using this card. Not just for AirAsia itself, you can use BigPay card to make payment for other airlines too. From there, you'll instantly earn points too.

- Top of every RM50 = 1 Big point

- Spend of every RM20 = 1 Big point

3) Save Money on AirAsia Flights

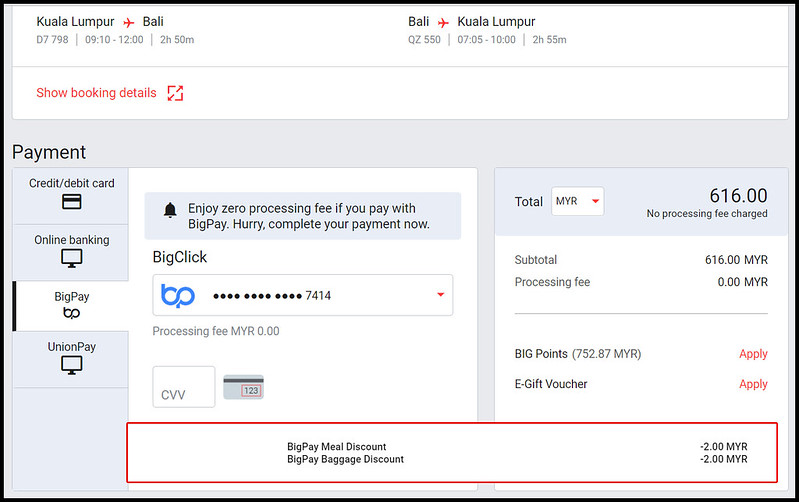

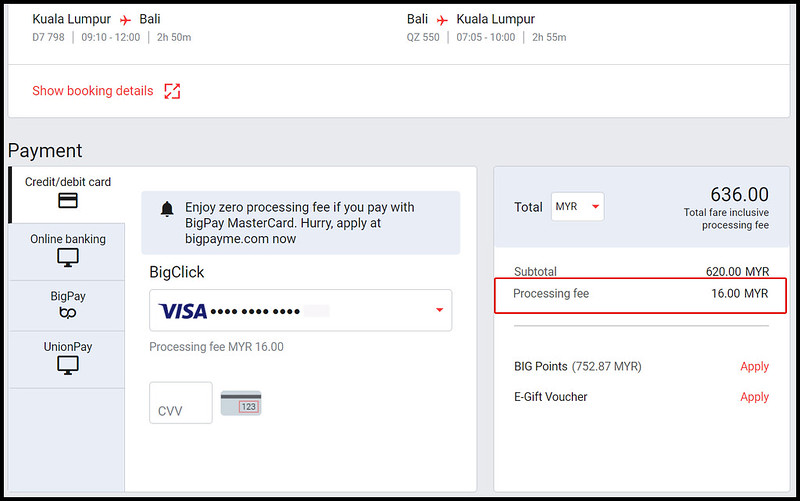

When you purchase a flight ticket from AirAsia, you know you'll being charged a processing fee of RM8 per person per way for both credit and debit card whereas RM4 for online banking. However, if you use your BigPay to make payment, you can enjoy zero processing fee. On top of that, you can even get exclusive discount for the add-on luggage and meals.

When purchasing AirAsia flight using BigPay card - Zero processing fee and discount for add-on luggage and meal.

Without using BigPay card

4) Instant Money Transfer

Not only for paying transactions, BigPay is also allowing you to transfer money to your friends or family. The entire process is fast and easy, without any extra fees being charged. Let's say your friends and you yourself decided to split your dinner bill but then, you don't have any small change and so are your friends too. So the best way is by just transferring the money into your friend's BigPay account.

5) Easy Access and Tracking

If you want to trace the transactions you done previously, you can do so by just log in into your apps and key in your 6-digit passcode rather than entering both username and password which I personally think it's time consuming. Staying up to date on your spending has never been more hassle free. And in case you notice there's unauthorised transactions, you can immediately freeze your card through the apps.

So How To Apply Big Pay Card?

1) Download BigPay - Asia's Money app from Goggle Play Store/App Store and it's completely free to get this card.

Use my referral code and you'll get RM10 when you sign up!My referral code: FCO0WICSM0

(FCOzeroWICSMzero)

2) Since BigPay is a prepaid card, therefore you need to top up at least RM20 before receiving your card.

3) Once you get your card, activate it and you will receive RM10 from using the referral code. So in total, you'll get RM30.

The Downside of BigPay Card

Somehow BigPay do have it's own drawbacks too. The most common problem I encounter is sometimes the payment I made failed or being declined. Therefore, it's wise not to transfer all your money from your bank account to BigPay. What I normally do is top-up when I feel it's necessary or when the amount is insufficient. Don't be so silly and transfer all your money just for the sake of earning the points. This is because once the transfer done, you unable to transfer back the money store inside your BigPay account into your associated bank account anymore. Be a smart user 😉

Another thing you should take note is that withdrawals performed in Malaysia is subjected to a fee of RM6 per transaction and overseas withdrawals will be charged at RM10 per transaction.

Conclusion, if you are someone who love to travel like I do, then you should sign up and apply for a BigPay Card. This card really gives me a peace of mind without have to worry of the exchange rate. Now I know which card should I use to pay for my ACCA subscription fee of £246.

Now I can shopping abroad without worry about the exchange rate. Thanks to BigPay Card!

Another thing you should take note is that withdrawals performed in Malaysia is subjected to a fee of RM6 per transaction and overseas withdrawals will be charged at RM10 per transaction.

Conclusion, if you are someone who love to travel like I do, then you should sign up and apply for a BigPay Card. This card really gives me a peace of mind without have to worry of the exchange rate. Now I know which card should I use to pay for my ACCA subscription fee of £246.

Now I can shopping abroad without worry about the exchange rate. Thanks to BigPay Card!

Really useful resource here to see the must have travel sights of Malaysia! Whatever your goal likes paragliding, snorkeling, surfing, underwater surfing, swimming, zoo entertainment, Water Park, sunrise and sunset views at the sea shore, the exclusive tour guide expert GMTC Tours & Travels makes your tour memorable at special tariff that every fans could afford to enjoy the deals once in a lifetime. Connect us online for early bird discount confirmation.

ReplyDeleteThis information is useful and I trust your every word on this card! Now I will consider this since I am planning for my UK trip soon.

ReplyDeleteThanks to this information and referral, I signed up for BigPay and can't wait to get the card. It's really good that you wrote about this Diana!

ReplyDeleteCheers,

Fie

thanks for the information. i just received my card today. registered using your referral...yeah thank you!

ReplyDelete